Home Equity Line of Credit

Leverage your home’s equity to pay for large expenses

One of the best perks of being a homeowner is the ability to build equity over time. Home equity is the difference between how much you owe on your mortgage and your home's current value.

Cedar Point Federal Credit Union® can help you get a Home Equity Line of Credit (HELOC) to use as a revolving credit line against large expenses. You can borrow money as needed up to an approved credit limit, much like a credit card.

A few ways you can use a HELOC include:

- Home improvements and repairs

- Unexpected expenses or emergencies

- Education expenses

- Medical bills

- Consolidating debt

- Weddings or other significant events

- Other major expenses

Our friendly and experienced Mortgage professionals can help guide you through the process of getting a HELOC at a low interest rate. You can get started by requesting more information or submitting an online application.

How Does a HELOC Work?

A HELOC is a line of credit that is secured by your home. Terms include variable interest rates, a draw period, and a repayment period. The draw period (10 years) is the time period you may borrow the equity captured by the HELOC. This is followed by an additional 10-year repayment period. During this time, you can no longer draw against any remaining equity. When the repayment period ends (total loan maturity of 20 years), the HELOC will be paid in full.

Why get a HELOC?

A HELOC offers flexibility, allows you to access a significant amount of credit, and could provide tax benefits (please consult your accountant).

Ideally, the equity in your home could go up every year as home values rise, and your loan principal will decrease by making monthly payments. Keep in mind that market conditions could cause your home to lose both value and equity. It’s important to act quickly to capture the equity you may have today.

Here are some reasons why a HELOC may be right for you:

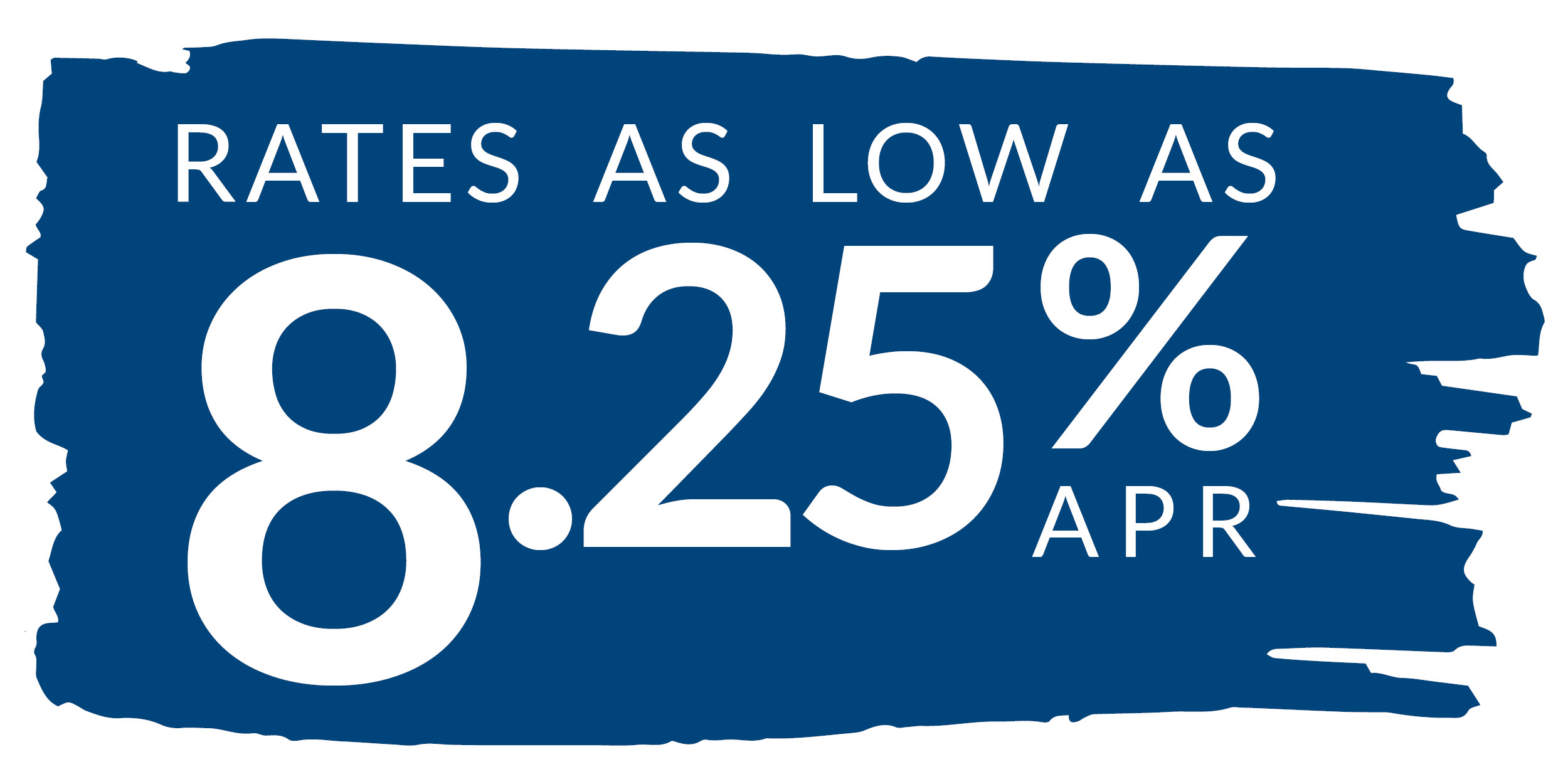

- Low Interest Rates – With rates as low as 8.25% APR*, you could save on interest expenses from high-rate credit cards or loans.

- Return on Investment – Using a HELOC to renovate your home? Investing in your home is a smart idea because it could possibly increase your home’s value, which could help your home sell more quickly and for more money.

- Flexible Borrowing – You can use as much or as little money as you need and only pay back what you use.

- Quick and Easy – Our in-house equity experts can provide estimates of what you qualify for in as little as one business day. Plus, our online application makes applying a breeze.

- Streamlined Payment – Using a HELOC to consolidate debt? Simplify your finances by consolidating multiple payments to various lenders into one convenient payment per month.

- Credit Score Boost – Having high credit card balances relative to your limits can hurt your credit score. Reducing those balances by transferring that debt to a HELOC could improve your credit score over time.

Meet our Mortgage Team

Cedar Point’s Mortgage Services Department is a superb example of the standard of service we provide to our members and the community. Our friendly and experienced Mortgage Team members can help guide you through the process of getting a HELOC at a low interest rate.

Contact the Team

Send the Mortgage Services Department a message via our online form, or contact them by phone or fax at the following numbers:

- Phone – 301-863-7071

- Fax – 301-862-8186

- NMLS 449975

Quincy Williams

Mortgage Loan Manager

Ext. 8442

NMLS 1322422

Sherry Pickeral

Sr. Mortgage Originator

Ext. 8408

NMLS 509346

Shatoni Nesbitt

Mortgage Originator

Ext. 8474

NMLS 1631896

Brenda Hammett

Mortgage Servicing

Ext. 8445

NMLS 509347

Rebecca Paribello

Mortgage Servicing

Ext. 8444

NMLS 2362263

Valisa Tyler

Mortgage Processor

Ext. 8466

NMLS 1575864

Kaitlyn McKay

Commercial Mortgage Originator Processor

Ext. 8441

NMLS 2654016

Subordination Requirements

Cedar Point is pleased to consider subordination agreement requests. Please review our Subordination Requirements [link to PDF] to learn about the documents needed to process these requests.

Home Mortgage Disclosure Act Notice

The HMDA data about our residential mortgage lending is available for review. The data shows geographic distribution of loans and applications; ethnicity, race, sex, and income of applicants and borrowers; and information about loan approvals and denials. Inquire at any office regarding the Cedar Point branch locations where you may inspect HMDA data.

*Best rates are based upon approved credit. The rate is a variable rate and may increase. Maximum rate is 15%. Closing costs estimated at $2,200 to $2,400 on a $60,000 HELOC. APR = Annual Percentage Rate. Rates accurate as of December 23, 2024.